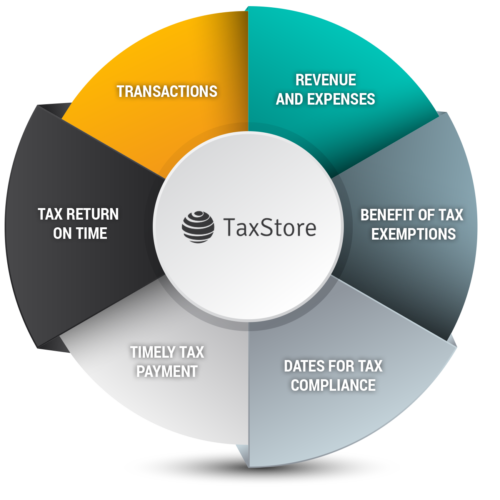

In 2018, the Supreme Court favored the state in South Dakota v. Wayfair which was the basis for the South Dakota legislature to enact a law requiring out-of-state sellers to collect and remit sales tax “as if the seller had a physical presence in the state.” Other states have adopted this Act whereby sellers that, on an annual basis, deliver more than a specific dollar amount of goods or services into a state or engage in 200 or more separate transactions for the delivery of goods or services into the state, are now required to collect and remit sales tax once they meet the specific threshold. This means that remote sellers with no employees or property in each state, can still meet the minimum sales or transactions requirement at which time they would need to register, collect and remit sales tax. We can assist you by reviewing your sales history to determine whether you have met the economic nexus threshold required for registration to collect and remit sales tax in US jurisdictions.

State and local jurisdictions frequently conduct audits to determine if businesses have underpaid taxes or whether they are eligible for a refund for any overpayment of taxes. We can work with you to manage your audit engagement and help to identify ways to minimize assessments.

Whether you need a review of current offerings or you are launching new products or services and need guidance on whether such a product or service is taxable and in what jurisdictions they are subject to sales or use tax, we have the right solutions for you to assist in determining the taxability for your goods or services.

Understanding your company’s operations and reviewing your purchase history can help to reveal instances where you may have overpaid sales tax on vendor invoices or have self-assessed use tax for transactions that may not be taxable or for which there might be an exemption available that you are unaware of.We can perform a comprehensive review of all your purchases that are within the statute of limitation period and work with you to recover any overpayments from the tax authorities.

Reporting of sales and use tax to state and local jurisdictions can be a cumbersome process which is why we offer tax return preparation service to take that hassle away from you. We can take all your tax data and ensure that it is reported to the proper tax authorities in a timely manner.

The world is constantly changing and so is your business model. From mergers and acquisitions to carve outs, we can review your business to ensure that your sales and use tax obligation is met when navigating these changes. You might be venturing into new markets and locations or closing business lines and need to determine your registration requirements or terminate your current registrations. We are there for you every step of the way to assess any requirements needed and perform the necessary due diligence to get you through this process.

If you have failed to register and file your sales or use tax in a particular jurisdiction, we can perform an extensive review of your records to determine any potential exposure and work with you to voluntarily disclose this exposure to the tax authorities to reduce any penalty impact from failure to timely file your returns. Also, states occasionally offer a limited period for taxpayers to come into compliance if there was an exposure. These programs vary by state and have specific deadlines that must be followed in order to receive the benefits that are typically available for registered and unregistered taxpayers. We can assist you in this process to help minimize any penalty and interest that may arise from being

non-compliant.

If you have instances where you have overpaid in any state or local jurisdiction, we can help you to prepare and submit refund claims to recover these overpayments. We can also follow up on any correspondence received regarding these claims from the tax authorities and offer support for any request for information.

After determining whether you are required to register and collect sales tax or if you need to self-assess and report use tax on purchases where sales tax was not paid at the time of purchase, we can assist in registering your company and getting you set up to start filing your returns.

If your business is making decisions or planning on embarking into business ventures and you would like to estimate any sales tax impact, or you might be in a situation where you are determining what is the best alternative (i.e. a business decision that results in the most favorable sales tax impact), we can help you in your impact assessment initiatives to help you stay informed so you can make the best possible decision.